Kenya has beautiful beaches with white sand and blue water. Many people from other countries dream of living here. This guide will help you if you are thinking about buying beachfront property in Kenya.

Foreigners are welcome to invest by buying beachfront property in Kenya, but it comes with one major rule: you can only own it on a 99-year leasehold, not permanently (freehold). The most popular areas for investment are Diani, Watamu, and Malindi, each offering strong rental income potential. To do it safely, you must hire an independent lawyer to verify the property’s title and navigate the legal process.

This article by our legal and editorial team talks about the best beach towns, explain the rules, and tell you about the money you will need to buy your dream home safely.

Foreign Ownership Rules for Beachfront Property in Kenya Explained

The Kenyan law treats land ownership differently for citizens and non-citizens. If you are a foreign buyer, the most important thing to know is that the law limits your ownership to a lease for up to 99 years.

That rule applies whether you buy the land as an individual or through a foreign company. This affects price, resale, and long-term planning.

Top Locations for Buying Beachfront Property in Kenya

- Diani (Kwale County): popular, well-developed, strong tourist demand.

- Watamu (Kilifi County): quiet, eco-tourism hub with steady holiday rental demand.

- Malindi & Kilifi (Kilifi County): established resorts, international buyers, older expat communities.

- Lamu (Lamu Archipelago): cultural island, luxury and niche tourism market.

- Vipingo & Shanzu (near Mombasa/Nairobi corridor): growing developments and gated resorts for higher-end buyers.

Kenya’s Top Beachfront Locations: Where to Invest

1. Diani

Diani is located South of Mombasa, about 30-45 minutes from the airport (Mombasa International Airport). It is often ranked as one of the best beaches in Africa. It is the most developed and popular beach destination for tourists and investors.

Why Invest in Diani

- Stunning Beauty: It is popular with its wide white-sand beaches lined with palm trees and clear turquoise water and many resorts.

- Great Infrastructure: Infrastructure has improved (roads, supermarkets, restaurants and world-class hotel investment), which helps property values rise. Diani is strong for holiday rentals and resale. An airlift connects Diani to the mainland, avoiding ferry delays.

- Strong Rental Market: Because it is so popular with tourists, you can earn a good income by renting out your property. Management companies can handle this for you.

- Vibrant Community: A large community of foreign residents and investors means good support networks.

Things to Consider:

- It is the most exclusive beach location in Kenya. You will pay a premium for property here.

- It can be busy during the peak tourist seasons (November-February, July-October).

2. Watamu

Location: North of Mombasa and part of the Malindi-Watamu coastline.

Watamu is known for being a quieter environment but more tranquil alternative to Diani. It is also known for its serene beauty and is a UNESCO Biosphere Reserve.

It also has very clear waters, reefs, and nature reserves drawing eco-tourists and divers. Short-term rentals do well here — many tourists book villas and small hotels. Prices are often lower than Diani but can still give solid rental income.

Why Invest in Watamu

- Natural Beauty: Blue and peaceful beaches. It is home to turtle nesting sites and the Watamu Marine National Park, perfect for snorkelling.

- Luxury and Privacy: Watamu attracts those looking for a more exclusive and quieter getaway. There are many high-end, private villas.

- Golf and Nature: It also has a famous golf course and is close to the Arabuko Sokoke natural forest.

- Growing Market: While it is established, it feels less crowded than Diani, offering a sense of discovery.

Things to Consider:

It is quieter, with less nightlife than Diani.

The tourist season is strong, but the off-season can be very quiet.

3. Nyali and Bamburi (Mombasa North Coast)

They are located just north of Mombasa Island, across the channel and connected by the Nyali Bridge. Making it the most convenient location for accessing the city’s amenities.

Why Invest in Nyali & Bamburi

- City Convenience: These are located minutes from Mombasa’s banks, hospitals, international airport, and large shopping malls.

- Presence of good beaches and vibrant activities: The beaches are beautiful and offer a wide range of water sports, restaurants, and beach clubs.

- Established Market: A very safe and established property market with many gated communities and apartment complexes.

Things to Consider:

The beaches, while beautiful, can be narrower and more tidal than in Diani or Watamu

It feels more urban and less like a remote tropical escape.

4. Malindi & Kilifi

These towns further North of Mombasa and have a long history with foreign buyers (especially Europeans). Malindi has a big expat community, while Kilifi and nearby Vipingo have new gated developments and golf resorts.

Additionally, Kilifi is quickly becoming the hotspot for a bohemian and eco-conscious crowd. It offers a unique blend of raw beauty and a growing creative community.

Aspiring buyers on this these towns are encouraged to be aware of local planning and big projects (which can be good or risky).

Why Invest in Malindi and Kilifi

- Beautiful Landscape: Kilifi Creek is a stunning large inlet, offering both beachfront and creek-front properties. The views are spectacular.

- Lower Prices: Property is relatively more affordable here than in Diani or Nyali, offering great potential for value growth.

- Growing Community: A vibrant community of artists, entrepreneurs, and environmentalists is creating a unique culture.

- High Growth Potential: Many see Kilifi as the “next big thing,” so getting in now could be a smart investment while Malindi has been formidable tourist spot for a long time with vibrant foreign community restaurant, shopping complexes.

Things to Consider:

Infrastructure is still developing. You are likely will find fewer large supermarkets and international restaurants in Kilifi, however, that is not the case in Malindi.

Both towns are best for those who value community and nature over convenience.

5. Lamu Island

Lamu is located far North of Mombasa and easily accessible by a short flight from Malindi. It is an historic and less developed town. It attracts niche luxury buyers and tourists who want slow life and vibrant culture.

It is also a UNESCO World Heritage Site, an ancient Swahili settlement with narrow streets, donkey rides, and traditional dhows sailing the water.

Why Invest in Lamu

- Unique Culture: You are investing in a piece of living history. The culture and architecture are unlike anywhere else.

- Total Escape: It is the definition of peace and quiet. There are no cars on the main island just traditional means of transport i.e donkeys and donkey carriages

- Exclusive Market: Property here is for a specific, discerning investor who values heritage and tranquillity.

Things to Consider:

The remoteness can be a challenge for construction and access to certain services.

The cultural and architectural rules are strict to preserve the island’s heritage.

Your Legal Checklist for Buying Beachfront Property in Kenya

- Leasehold only (max 99 years): All non-citizens get leasehold for up to 99 years. Any document giving more will be treated by law as a 99-year lease. Plan for lease-end and renewal rights.

- Check the title at the Lands Registry: always confirm the title type (freehold or leasehold), owner, mortgages, caveats, and encumbrances. Use the official land registry or a lawyer to pull the title.

- Avoid buying disputed property: beachfront areas have had historical disputes or competing claims. If history looks messy, walk away or insist on a court-clear title.

- Use a Kenyan lawyer and licensed agent: the lawyer should do conveyancing, checks, stamp duty calculations, and register the transfer. Agents help find property but don’t replace legal checks.

- Pay stamp duty and register the transfer: stamp duty and registration must be done before the title is fully transferred. For properties in towns the usual stamp duty is commonly 4% of value (check current rates).

- Consider a corporate structure carefully: buying through a foreign company does not avoid leasehold limits; foreign-owned companies are treated as foreign persons for land law. A Kenyan company wholly owned by citizens can hold freehold (but that changes control).

- Check planning and environment rules: some coastal strips have protected areas, setback rules, or planned public access to beaches. Large projects may need environmental permits. An example: proposals like large energy projects in Kilifi have raised environmental concerns that could affect local tourism and property values.

- Hire a Lawyer: Never buy property in Kenya without engaging an independent lawyer. Do not rely on the seller’s lawyer.

- Perform Official Search: Your lawyer must go to the Lands Registry to check the title deed. This confirms the true owner and that there are no loans or disputes on the property.

- Check for Consents: Beachfront property is often bound by extra rules. An advocate must check that all necessary government and environmental consents are in place for the sale.

- Understand the Costs: Budget for extra costs like Stamp Duty (a government tax of 4% of the property value), legal fees (1-2%), and agent fees.

Property types to avoid

- “Group Ranch” Land: This is always community land. The sale process is very complex and often leads to disputes. Always insist on land with a standard, individual title deed.

- Impatience: The legal process can be slow. Do not rush. A correct, slow process is better than a fast, faulty one that loses you money.

- Agricultural beachfront plots are tightly restricted, it’s therefore advised to focus on residential/tourism properties.

Costs and Returns

- Purchase price: varies by location and proximity to the sea. Diani and top beachfront villas are premium. Watamu and Malindi are often cheaper.

- Stamp duty: it is normally up to 4% in urban areas (confirm current KRA rules).

- Legal & registration fees: it’s recommended to budget 1–3% or a fixed fee for conveyancing and searches.

- Annual costs: consider property rates (local), utilities, maintenance, and management fees if you rent short-term. Short-term rental markets (Airbnb/STR) in places like Watamu show steady occupancy for well-managed homes.

Return on investment depends on occupancy, season, and quality of the house. Well-located, well-run holiday homes can earn good rental income.

Tourism can be seasonal and sensitive to events (political, environmental, health).

Final Safety Checklist Before Signing for Your Beachfront Property

- Verify title and land owner.

- Confirm no mortgages or court cases.

- Ask for a physical survey and boundary marker.

- Confirm planning permission for the building.

- Use bank transfers and get receipts — avoid cash deals.

- Meet neighbours and learn about beach access rules.

Here’s a summary table of top beachfront locations in Kenya for foreign investors, with pros, cons, and notes on legal and cost issues.

Table: Top Beachfront Locations in Kenya for Foreign Investors

| Location | Key Attractions | Pros | Cons | Typical Property Notes |

| Diani (Kwale County) | Long white beaches, strong tourism, good air link via Ukunda | High tourist demand, good rental returns, improving infrastructure | Higher prices, more competition, peak-season dependency | Villas and apartments on 99-year leasehold; premium beachfront costs more |

| Watamu (Kilifi County) | Marine park, eco-tourism, diving, reefs | Steady holiday rentals, quieter lifestyle, eco-friendly appeal | Seasonal demand, limited large developments | Villas and cottages; mid-range to high-end leasehold options |

| Malindi (Kilifi County) | Established expat community, Italian influence, resort town | Older expat market, rental income from resorts | Some areas less developed, older infrastructure | Mixture of villas, townhouses, and resort properties; leasehold |

| Kilifi & Vipingo (Kilifi County) | New resorts, golf courses, close to Mombasa | Modern gated communities, long-term growth potential | New developments mean resale market less tested | High-end gated homes, golf estate properties; leasehold |

| Lamu (Lamu Archipelago) | Historic Swahili culture, boutique luxury | Exclusive, cultural appeal, niche luxury buyers | Limited transport, political/security perceptions | Restored Swahili houses, boutique villas; leasehold, low liquidity |

| Shanzu/Nyali (Mombasa area) | Proximity to Mombasa city, good rental base | Strong demand for serviced apartments, short-term rentals | Urban noise, mixed-use congestion | Apartments, condos, villas; convenient but less “retreat” vibe |

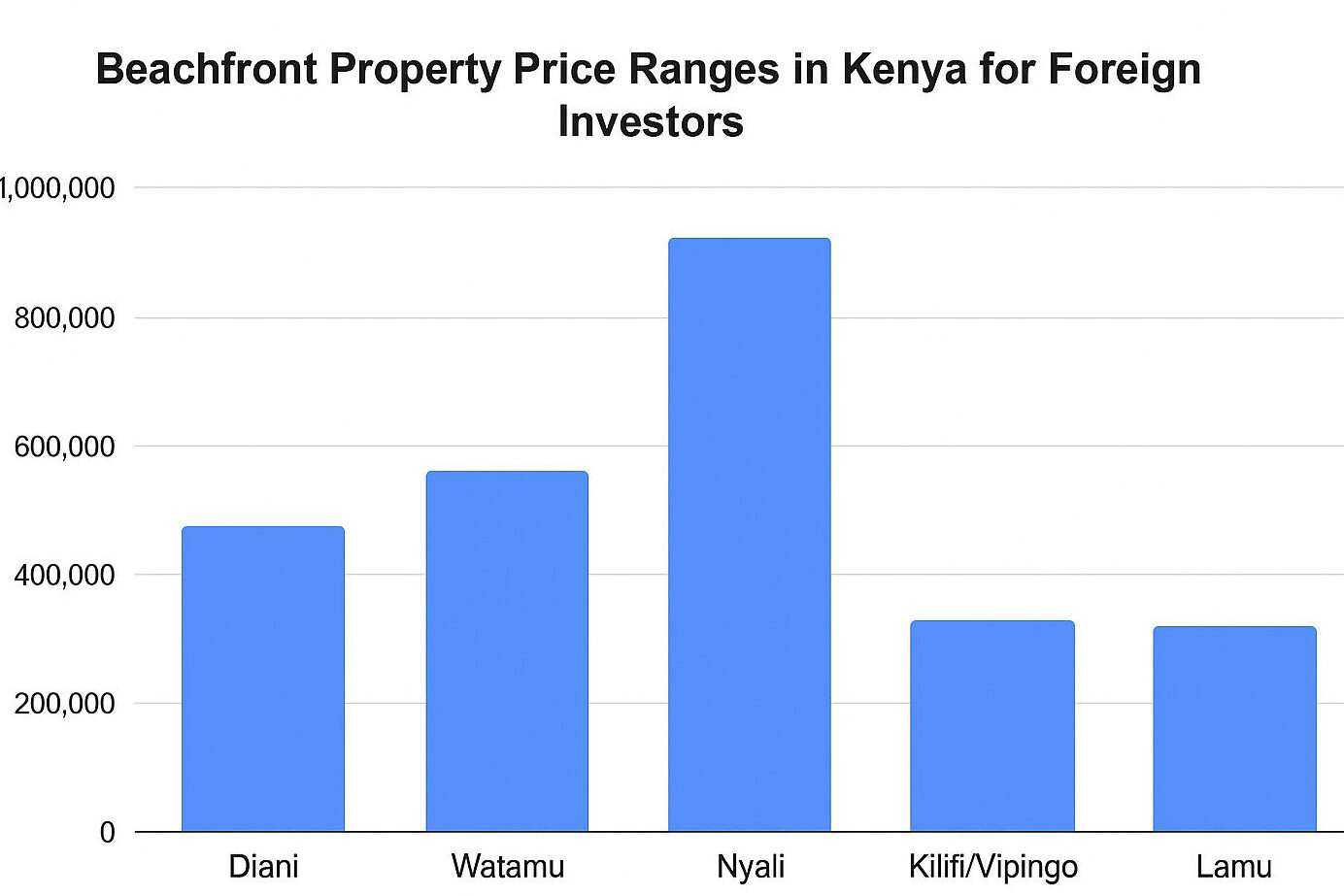

Beachfront Property Cost-Comparison Table (USD Estimates, 1 USD = 129 KES)

| Location | Example Property Price Range (USD) | Stamp Duty Estimate (Buyer Pays) | Rental Yield Estimate* | Notes / Comments |

| Diani (Kwale County) | Villas: $271,000 – $1,163,000+; Beachfront land / plots per acre: $155,000 – $310,000+ | Urban coast ~ 4% → On $387,000 villa, ≈ $15,500 duty | 10-20% gross per year (holiday rentals) | Prime demand, high tourist flow; erosion & upkeep costs |

| Watamu (Kilifi County) | Villas/apartments: $194,000 – $930,000; Mid-range homes: $93,000 – $465,000 | ~ 4% → On $310,000 property, ≈ $12,400 duty | 8-15% gross per year | Popular eco-tourism, diving; seasonal occupancy gaps |

| Nyali / Shanzu (Mombasa area) | Prime beachfront villas: $775,000 – $930,000+ | ~ 4% → On $850,000 property, ≈ $34,000 duty | 7-12% gross | Strong rental base; urban congestion a downside |

| Kilifi / Vipingo / Malindi | Villas/plots: $233,000 – $310,000+ (mid-high plots; luxury villas higher) | ~ 4% → On $270,000 property, ≈ $10,800 duty | 8-15% gross | Emerging markets; resale may be slower; infrastructure patchy |

| Lamu (Boutique Luxury) | Restored Swahili houses/villas: $174,000 – $698,000+ | ~ 4% → On $465,000 villa, ≈ $18,600 duty | 5-10% gross | Exclusive niche market; lower liquidity; security concerns linger |

Note: Rental Yield Estimate = gross yield before deducting maintenance, taxes, and management costs. Net yield will be lower.

Notes

- Foreigners buy leasehold only (max 99 years) — not freehold.

- Stamp duty = 4% urban, 2% rural (paid by buyer).

- Coastal homes = higher maintenance due to humidity and sea air.

- Peak rental demand during Dec–Feb (holiday season) and Jul–Sep.